- You are here:

- Home »

- Blog »

- CMA Exam Details »

- CMA Entrance Exam Curriculum by Parts and Topics

CMA Entrance Exam Curriculum by Parts and Topics

In order to become a CMA in the US, you have to go through the CMA entrance exam. What exactly does it cover? Is it very difficult? Let’s take a look.

CMA Entrance Exam: The Format

The exam is 100% computerized with 100 multiple choice questions and two 30-minute essay questions. It consists of the following parts:

- Financial Planning, Performance and Control

- Financial Decision Making

Candidates are free to take either one or both parts of the exam within the same test windows. The exams have to be completed within 3 years, counting from the date the candidates pay the entrance fee.

New CMA Exam Format Effective 2015

This page is now updated with the latest syllabus. The 3 major changes are:

- Additional content related to external financial reporting in Part 1

- A new section on strategic planning included in Planning, budgeting and forecasting in Part 1

- Professional ethics now tested only in Part 2

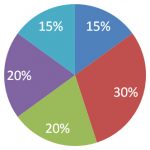

CMA Exam Part 1

CMA Exam Part 2

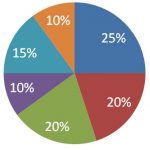

- Financial statement analysis (25%)

- Corporate finance (20%)

- Decision analysis (20%)

- Risk management (10%)

- Investment decisions (15%)

- Professional ethics (10%)

More Information On Each Topic

CMA Exam Part 1

External Financial Reporting Decision

- New to the CMA exam covering basis of financial accounting.

- Preparation of financial statements.

- Valuation of assets and liabilities.

- Operating and capital leases.

- Impact of equity transactions.

- Revenue recognition; income measurement; major differences between U.S. GAAP and IFRS.

Planning, budgeting, and forecasting

- How to annual profit plans and supporting schedules.

- Different types of budget e.g. activity-based budgeting, project budgeting and flexible budgeting.

- Top-level planning and analysis.

- Forecasting including quantitative methods e.g. regression analysis and learning curves.

Performance Management

- How to analyze the finance statement items such as revenue, cost, profit and investment in assets.

- Variance analysis based on flexible budgets and standard costs.

- Responsibility accounting for revenue, cost, contribution and profit centers.

- Balanced scorecards

Cost Management

- Cost concepts, flows and terminology.

- Alternative cost objectives.

- Cost measurement concepts.

- Cost accumulation system e.g. job order costing, process costing, activity-based costing.

- Overhead cost allocation.

- Operational efficiency and business process performance topics e.g. JIT, MRP, theory of constraints, value chain analysis, benchmarking, ABM and continuous improvement.

Internal Control

- Risk assessment

- Internal control environment, procedures and standards.

- Responsibility and authority of internal auditing.

- Types of audits.

- Assessing the adequacy of accounting information systems control.

CMA Exam Part 2

Financial Statement Analysis

- Principal financial statements and their uses.

- Limitation of financial statement information.

- Interpretation and analysis of financial statement e.g. ratio and comparative analyses.

- Market value vs book value.

- Fair value accounting.

- Major difference between IFRS and US GAAP.

- Off-balance sheet financing.

- Cash-flow statement preparation, analysis and reconciliation.

- Earnings quality.

Corporate Finance

- Types of risk.

- Measures of risk.

- Portfolio management.

- Options and futures.

- Capital instruments for long-term financing.

- Dividend policy.

- Factors influencing the optimal capital structure.

- Cost of capital.

- Managing and financing working capital.

- Mergers and acquisitions.

- International finance.

Decision Analysis

- Relevant data concepts.

- Cost-volume-profit analysis.

- Marginal analysis.

- Make vs buy decisions.

- Pricing.

- Income tax implications for operational decision analysis.

- ERM.

Risk Management

- Operational risk, Hazard risk and financial risk and strategic risk.

Investment Decision

- Cash flow estimates.

- Concepts of DCF (discounted cash flow), net present value, IRR (internal rate of return).

- Non-discounting analysis techniques.

- Income tax implications for investment decisions.

- Ranking investment projects.

- Risk analysis.

- Real options.

- Valuation models.

Professional Ethics

- Ethical consideration for both management accountants and the organization.

Next Reading: The Exam’s Format

Structure and Duration

For Your Further Reading

Exam content, pass rate trend and difficulty of:

For specific information on the CMA entrance exam together with study tips and exam tactics, please consider signing up for our free mini course here:

Join us if you want to get tips on how to plan,

study and pass your CMA exam… on your first attempt!

Source: CMA Candidate Handbook

About the Author Stephanie Ng

I am the author of How to Pass The CPA Exam (published by Wiley) and the publisher of this and several accounting professional exam prep sites.