- You are here:

- Home »

- Blog »

- CIMA Exam »

- CIMA Certificate in Business Accounting: Is the Qualification Worth It?

CIMA Certificate in Business Accounting: Is the Qualification Worth It?

CIMA Certificate in Business Accounting: An Overview

The Certificate in Business Accounting, or Cert BA, is the first step towards your CIMA designation:

Cert BA Prerequisite

There is no prerequisite for the Cert BA, but you are required to have a good knowledge in English and Mathematics.

In order to obtain this certificate, follow this step:

- Register as CIMA student

- Study for and pass the Cert BA Exam, as described below

If your goal is to obtain the CIMA membership and CGMA designation, and you have:

- university degree in accounting, business, management or finance

- Master’s degree in accounting or an MBA; or

- Accounting and finance related professional designation

You can waive the Cert BA requirement and go straight to take the CIMA exam. We have more details on the registration process here.

Start taking your CIMA exam hereCert BA Exam Syllabus

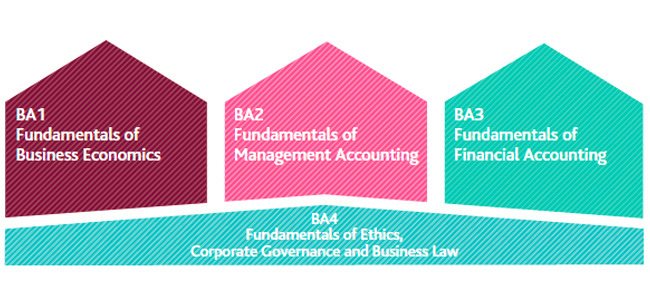

The CIMA Certificate in Business Accounting is divided into 4 exam parts, known as BA1, BA2, BA3 and BA4.

B1A: Fundamentals of Business Economics

This subject introduces the role of an accounting and finance professionals in business. It covers the big picture view, more on an economics point of view, on how business works and relates to each other.

- Macroeconomic and institutional context of business (25%)

- Microeconomic and organisational context of business (30%)

- Informational context of business (20%)

- Financial context of business (25%)

BA2: Fundamentals of Management Accounting

This subject covers management accounting in broad spectrum, from why management accounting is needed for management decision making, to the general concepts in costing, planning and control. It does not go into too detail on the complex management accounting tools. This will be covered in the Professional Qualification stage.

- Context of management accounting (10%)

- Costing (25%)

- Planning and control (30%)

- Decision making (35%)

BA3: Fundamentals of Financial Accounting

This subject focuses on financial accounting and reporting. At the Cert BA level, emphasis is more on the practical and technical side of accounting, with half the weighting on the recording process. This will be the work performed by an accounting clerk and junior accountant.

- Accounting principles, concepts and regulation (10%)

- Recording accounting transactions (50%)

- Preparation of accounts for single entities (30%)

- Analysis of financial statement (10%)

BA4: Fundamentals of Ethics, Corporate Governance and Business Law

This last subject is not as technical but a very important topic, especially in light of epic corporate failures in the past 10 years. The importance ethics, governance and internal control is covered here.

- Business ethics and ethical conflicts (30%)

- Corporate governance, controls and corporate social responsibility (45%)

- General principles of the legal system, contract and employment law (15%)

- Company administration (10%)

Cert BA Fees

The Cert BA cost varies depending on where you register for the exam, and whether you are able to pass on your first try. Here is a typical cost breakdown for your reference:

- One-off registration fee: GBP 77

- Cert BA exams x 4: GBP 280

- Study materials:

- CIMAstudy Prime Module x 4: GBP 960

- CIMA study text x 4: GBP 140

Total Cert BA Cost: GBP 1,492

Cert BA Exam Format

Each Cert BA exam is 120 minutes long. The first three has 60 objective test questions, and the last one, BA4, has 85 questions. Objective test questions means multiple choice questions.

In other words, you have 2 minutes for each of questions in BA1,2 and 3; and about 1.5 minutes for each question in BA4.

Cert BA Exam Pass Rates

For the Cert BA Exams, there are varying difficulties among the 4 papers. Strictly based on the passing rates, BA2 is the toughest while BA 1 is the easiet (with BA3 as close second). Overall, the pass rates are quite high for first-takers and for those who keep trying hard:

| BA1 | BA2 | BA3 | BA4 | |

| First timers + Retakers | 79% | 73% | 79% | 74% |

| First timers | 75% | 65% | 80% | 60% |

| Overall pass rate | 70% | 60% | 69% | 56% |

Summary

The Certificate in Business Accounting is not hard to get if you put in the time and effort to build up the foundations necessary for your business and finance career. If you have any questions, please drop a note in the comment section below. All the best!

For Your Further Reading

About the Author Stephanie Ng

I am the author of How to Pass The CPA Exam (published by Wiley) and the publisher of this and several accounting professional exam prep sites.