- You are here:

- Home »

- Blog »

- Candidate Stories »

- CFA and CMA Program: Is it Really that Different?

CFA and CMA Program: Is it Really that Different?

Saher is a 21-year-old Indian residing in Dubai. She took Part 1 and 2 back-to-back after passing her CFA level 1 in June.

Saher is a 21-year-old Indian residing in Dubai. She took Part 1 and 2 back-to-back after passing her CFA level 1 in June.

I haven’t been able to find time to write new posts — I am busy with the new job and preparation for CFA level 2. While I was studying one night, I thought it would be great to lay out the differences between the CMA and CFA program.

Accountancy and Finance are often positioned together in undergraduate education or in occasional chit chat. But they both have distinctive identities. Understanding these 2 prestigious programs will give us an idea about the two worlds.

CMA stands for Certified Management Accountant, whereas CFA stands for Chartered Financial Analyst. Farther in this blog post, I will compare the two under various elements.

CFA vs CMA: The Basics

To understand which of these two certifications is best for your needs – or if you should get both – it all begins with knowing the basics. Accounting professionals who want to get their certifications can choose from the CPA, CFA, and CMA to name a few.

How similar are the CFA and CMA? Does the content overlap? And if so, when and where? While there are some overlaps in the content that is covered, these two certifications actually lead down very different career paths. The only time you will ever really need to choose between them is when you are still trying to decide which career path you want to take. If you’ve already made this decision regarding career path, then the decision is pretty easy.

The main difference between these two certifications is the skills they provide.

Let’s explore both to help you decide.

CFA vs CMA: What is the CFA?

CFA stands for Certified Financial Analyst, and this is a designation for finance and investment professionals. It will focus on skills in Investment Analysis, Portfolio Strategy and Corporate Finance to name a few. The types of jobs you will have as a CFA include equity research, asset management, investment management, hedge funds, and similar.

CFA Benefits

There are definite benefits to the CFA certification. It is basically the gold standard for the finance and investing community. It will come with clout and the knowledge obtained in the CFA will greatly help you on the job. But what are some other benefits?

For one, it has a broader coverage area than the CMA. This means your skills will be relevant to a broader industry and it could also help open new doors for you. There is also a much bigger membership base in the CFA community versus the CMA.

Furthermore, the CFA community is 122,000+ strong, vs 70,000 for IMA members and around 20-30K active CMAs. This means there are better networking opportunities within the CFA community as well.

CFA vs CMA: What is the CMA?

CMA stands for Certified Management Accountant, and as the name suggests, it’s a specialty in management accounting. It also covers financial accounting and strategic management. This is designed mainly for accountants who are working outside of CPA firms. Pretty much 3/4 of all practicing accountants are working with the CMA knowledge. It is not helpful to those working with cost and inventory accounting.

CMA Benefits

One major benefit to the CMA is that you can complete it within a few months. It is designed to be completed within a year and there are two parts you can study and test for individually. There are fewer exam sections, and the exam is not as broad. Many candidates feel this makes it much easier to study and prepare for.

Another benefit with the CMA vs the CFA is that there is more flexibility with when you can schedule it. You can take the exam on any weekday that falls within the testing window. This testing window is available for six months out of the year, giving you much more time to book in your testing. The CFA does not have flexible exam dates and is only held twice a year for the first level and only once a year for the second and third level.

The fastest you could possibly complete the CFA based on this testing schedule is 18 months. However, most candidates take about your years to get it done.

Finally, another benefit to the CMA is that it is very relevant in corporate accounting. Every company needs an accounting team but they don’t all need a finance team. This means you can have more career options when you choose the CMA certification.

Now, let’s look more into those career options for each certification.

CFA vs CMA: CFA Careers

How do these two stack up when it comes to choosing your career? Actually, they can lead to very different career paths so the best and first step of choosing between them is to know what career path you intend to take.

Some jobs you may have with a CFA include:

- research analyst

- relationship manager

- chief executive

- consultant

- corporate financial analyst

- portfolio manager

- risk manager

- financial advisor

CFA vs CMA: CMA Careers

There are many jobs you can have as a CMA, too. As you move up in experience, you can get higher-paying positions and career options. Here are some of the job titles you might hold with your CMA:

- finance manager

- financial analyst

- financial risk manager

- financial controller

- cost accountant

- chief financial officer

- cost manager

- relationship manager

Now, if you’re still asking which is better, CFA or CMA, let’s look into some more information about the exams themselves.

Stages to Complete

How many stages does each certification exam have for you to complete in order to pass and obtain the title?

The CFA program has 3 levels that need to be taken in the order of 1, 2 and 3. On the other hand, the CMA program has 2 parts that can be taken in any order.

When looking strictly at stages to complete, the CMA is easier and it also has a more flexible schedule in which to do the 2 parts.

Next, let’s look at the time needed to take these exams. Are you wondering which is faster to take, the CFA or the CMA?

Time Taken

How much time will you spend on each of these exams?

The CFA exam can take a minimum of 1 and a half years to complete. The CFA examination can be taken once each year (first Saturday of June) for level 2 and 3 and twice in the year for level 1 (first Saturday of June and/or first Saturday of December). This means that if you miss out the opportunity to write the exam in a particular year, you have to wait for a year to re-attempt.

The CMA exam has multiple windows (January / February, May / June, and September / October). The examinations can be completed within 6 months. It is easier for most people to complete the CMA faster because it is simply more flexible in when it offers testing times.

Experience Requirement

Another important consideration when deciding which certification you want to get is the experience requirement. How much experience will you need for each certification?

The experience requirement for CFA is 4 years and the eligible work experience criteria are more stringent while the experience requirement for CMA is 2 years and the eligibility criteria is more liberal.

Next, let’s look into the exams themselves with more detail.

The Examination

The CFA exam is broken into a morning and an afternoon session of 3 hours each. The morning session is 9 am – 12 pm and the afternoon session is 2 pm – 5 pm. The exam duration is a total of 6 hours done on paper.

Level 1 is a multiple-choice based examination, Level 2 is a multiple choice and item set based examination and Level 3 is a combination of multiple-choice and essay-based questions

Both parts of the CMA exam are a 4-hour long exam to be completed electronically in the designated test center. The exam is a combination of multiple-choice questions (weighted 75%) and short essay questions (weighted 25%). The key here is that, if you don’t score a minimum of 50% in the multiple-choice questions, the system will not allow you to move on to the essay questions.

Results

Both CMA and CFA results arrive within roughly 6 weeks via email.

CMA results are reported as a scaled score between 0 – 500. A minimum of 360 is required to pass the exam.

CFA examinations, however, have a minimum passing score that is set only after taking into account the difficulty of that particular examination.

This minimum passing score is never revealed hence it is tough to know what you need to achieve to pass the examination. 6 weeks after the exam when your results arrive via email, you do receive a report. You will simply get a “PASS” or “FAIL”. This will be supported by a range within which your performance is rated in each of the 10 topics.

(Stephanie’s note: CFA exam candidates who fail are notified of their “bands”, that is, the range that they are in so they know how far off they are from passing)

CFA vs CMA Syllabus

Next, you need to look more deeply into the syllabus. Above, we only covered the basics of what each exam covers in terms of topics. How is the syllabus itself broken down?

Now getting to the real deal, the CFA program’s main goal at the end of the 3 levels is to produce a trained investment and financial professional. The CMA program, on the other hand, trains management accounting professionals.

While there are overlaps, accountancy and finance are 2 distinct and broad concepts. The good news is that for the CFA Level 1 exam, as much as 80% of the content overlaps with that of CMA Part 2 exam.

Topics in CMA Program (Part 1 and 2)

1A. External Financial Reporting Decisions (15%)

1B. Planning, Budgeting, and Forecasting (30%)

1C. Performance Management (20%

1D. Cost Management (20%)

1E. Internal Controls (15%)

2A. Financial Statement Analysis (25%)

2B. Corporate Finance (20%)

2C. Decision Analysis (20%)

2D. Risk Management (10%)

2E. Investment Decisions (15%)

2F. Professional Ethics (10%)

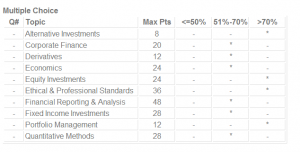

Topics in CFA Program (Weights change as per level)

1. Ethical and Professional Standards

2. Quantitative Methods

3. Economics

4. Financial Reporting and Analysis

5. Corporate Finance

6. Equity Investments

7. Fixed Income Investments

8. Derivatives

9. Alternative investments

10.Portfolio Management and Wealth Planning

Pass Rates

Finally getting to the pass rates, the CMA pass rates of Part 1 and Part 2 was 35% and 42% respectively. The CFA pass rates for June 2016 were as follows: Level I: 43%, Level II: 46%, Level III: 54%.

Overall, pass rates for both of these exams are lower than other accounting certifications. This could be partly due to the material covered and it could also be due to people not studying and preparing properly before taking the exam.

To ensure your best shot at passing on the first try, you will need to invest in study guides and practice materials. This adds on to the expenses of taking the exam and other costs involved with getting the certification. However, for either of these certifications, you’re going to see it pay off with the salary you can earn.

CFA vs CMA: CFA Salary

A big question for many accounting candidates looking to make a decision regarding which certification to get is “How much will it pay?” You will earn a nice salary with your CFA so it is definitely worth the investment. Current info from Payscale.com says that a CFA averages around $81,862. This is typically for a starter or entry-level position. That rate will go up from there, based on your job type.

Average salaries for CFA holders by job title:

- Financial Analyst (corporate) $80,930

- Portfolio Manager (fixed income) $253,250

- Chief Investment Officer $316,600

- Portfolio Manager (equities) $344,500

CFA vs CMA: CMA Salary

The CMA salary is also competitive. You stand to make a decent living no matter which certification you go for. Accounting to recent data from Payscale.com, the average salary for a CMA is $87,000. This goes up based on years of experience, where you love, and what position and title you hold.

For example, a Financial Controller averages $88,108. A Corporate Controller can average $99,633. And a Chief Financial Officer (CFO) can average $140,930.

Note from Stephanie

Thanks for the clear and detailed comparison of CFA and CMA programs. There are overlaps in exam content and the format is somewhat similar with multiple choice and essays in part of the exam. But then, as Saher said, the exams are designed for two separate career paths — one for management accounting and the other for finance and investment.

If you have the ability like Saher to tackle both exams, it’s great and this gives you a unique positioning in both fields. But for many of us who have quite a few family and work commitments, picking one over the other (at least for now) is a wiser choice.

To learn more about the CMA program, click around or start with this how-to page.

To learn more about the CFA program, you may want to start here.

We also have our analysis page on the comparison between CMA and CFA. If you have any other questions about CFA vs CMA that are not answered here, please reach out or leave them in the comments.

For Your Further Reading

- CMA vs CPA

- MBA vs CFA

- GMAT information (for general MBA information)

About the Author Saher M

Hey there, I am working in Dubai as Junior Associate in a management consultancy firm. I am a CFA level 2 candidate, and during the wait, I took and passed Part 1 and 2. I am now accumulating my experience to become a CMA.